We’ve collected 23 of the top bookkeeping templates for small business owners. Each template is free to download, printable, and fully customizable to meet your business needs.

On this page, you’ll find many bookkeeping templates, including a cash book template, a business expense spreadsheet, a statement of account template, and an income statement template.

Cash Book Template

Download Cash Book Template — Microsoft Excel

Record debit and credit transactions in this double-column cash book template to monitor your cash balance. Enter the date, description, and amount for each transaction, and the template will calculate subtotals and total cash balance.

Balance Sheet Template

Download Balance Sheet Template

MicrosoftExcel | Smartsheet

Use this balance sheet template to report your business assets, liabilities, and equity. The template calculates common financial ratios, such as working capital and debt-to-equity ratio. Edit the example line items to list all of your current and long-term assets and liabilities, and view subtotals for each section and column.

Trial Balance Worksheet

Download Trial Balance Worksheet

MicrosoftExcel | Smartsheet

This trial balance worksheet compares beginning and ending balances on each of your financial accounts based on debit and credit transactions over a given period. The template also calculates the total balance across all accounts and the total variance. Customize account titles and categories as needed to reflect your specific business.

Business Expense Template

Download Business Expense Template — Microsoft Excel

Keep track of business expenses with this simple spreadsheet template. Columns include Payment Date, Method, Description, and Amount. If you’re self-employed, include home office expenses and other deductibles to help save time during tax season. The template keeps a running subtotal of expenses, adjusting the total sum with each new entry.

Billing Invoice Template

Download Billing Invoice Template

MicrosoftExcel | Smartsheet

Save time on invoicing with this basic billing template. Customize with a logo and business details, and enter an invoice number, date, customer ID number, and payment terms for each invoice. Fill in the itemized list of payments due, and adjust the tax percentage to calculate the total amount owed.

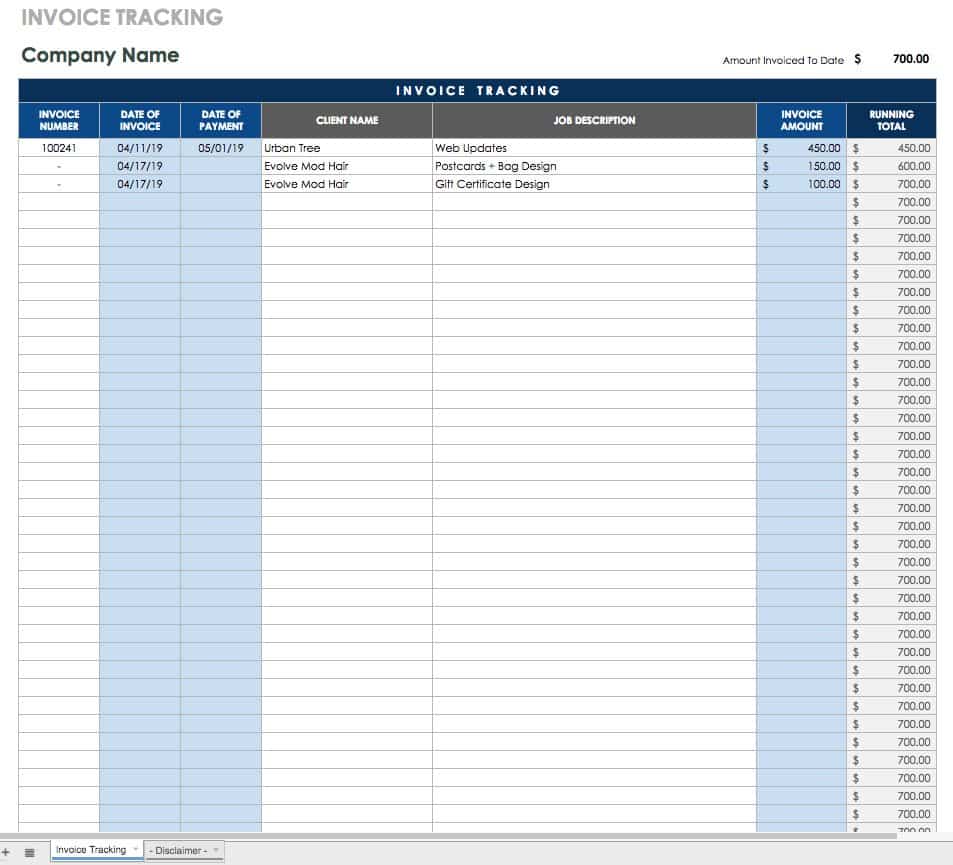

Invoice Tracking Template

Download Invoice Tracking Template — Google Sheets

Track all of your invoices with this simple spreadsheet. List each invoice by ID number, date, customer name, description, and amount. Add the date of payment when you receive a remittance. The template provides a running total each time you enter a new invoice and calculates the total amount invoiced to date.

Statement of Account Template

Download Statement of Account Template — Microsoft Excel

This statement of account template shows all of the financial transactions that occurred between your business and a customer during a certain time period. The template provides an account summary, including the customer’s previous balance, credits, current charges, balance owed, and due date. Customers also receive an itemized list of charges and credits, including invoice numbers, dates, and amounts.

Inventory Tracking Template

Download Inventory Tracking Template

Microsoft Excel | Google Sheets

Track the value of your current inventory and determine the cost of goods sold with this inventory tracking template. List physical inventory by item number, name, description, type, and location, and record purchases, including purchase dates, vendors, and prices. Compare the number of items sold to your monthly sales figures to make sure your inventory tracking sheet matches actual sales.

Accounts Receivable Template

Download Accounts Receivable Template

Microsoft Excel | Smartsheet

This template includes a ledger for tracking customer payments and an accounts receivable aging tab to track outstanding payments. The template automatically populates the accounts receivable aging sheet after you fill in the payment ledger. Add invoice terms, amounts, and payments received to view current and overdue balances.

Accounts Payable Template

Download Accounts Payable Template

Microsoft Excel | Smartsheet

This accounts payable template helps you track the money your business owes to vendors. List balances due, payments made, and supplier names, invoice numbers, and amounts. The template subtracts payments to show a running balance for each line item and displays the total amount due to all vendors at the top of the spreadsheet.

Simple Cash Flow Template

Download Simple Cash Flow Template

Microsoft Excel | Smartsheet

This basic cash flow statement tracks the movement of money in and out of your business and compares financial data between time periods. The template lists example cash receipts, payments, operating expenses, and additional costs. Use this template to review each item and determine the overall month-end cash position for each time period.

Quarterly Cash Flow Projections Template

Download Quarterly Cash Flow Projections Template — Microsoft Excel

Create a detailed report that displays quarterly cash flow projections. This template allows you to track the variance between your projected and actual cash position for each month and calculates total cash payments and net cash change.

12-Month Cash Flow Forecast Template

Download 12-Month Cash Flow Forecast Template

Microsoft Excel | Smartsheet

This simple but comprehensive template allows you to create a 12-month cash flow forecast for your small business. The spreadsheet includes monthly columns for recording forecasted and actual cash flow. List cash receipts and cash paid out to view your projected and actual cash position for each month.

Income Statement Template

Download Income Statement Template

Microsoft Excel | Smartsheet

Review revenue, expenses, and net income before and after taxes with this income statement template. The template accounts for all revenue sources and business expenses when calculating net income. Example revenue sources include sales, services provided, and interest. Business expenses include advertising, office equipment, insurance, utilities, and depreciation.

Profit and Loss Dashboard Template

Download Profit and Loss Dashboard Template — Microsoft Excel

This profit and loss dashboard template provides a visual overview of financial data, including total business income, cost of goods sold, gross profit, earnings before interest and taxes, and net revenue. Get a snapshot of your monthly profit and loss report by entering your financial data and selecting the month that you want to view in the dashboard.

Accounting Journal Template

Download Accounting Journal Template

Microsoft Excel | Smartsheet

Record debit and credit transactions and balances for multiple accounts in this accounting journal template. Edit the list of account descriptions and codes to match your business accounts. The template includes space to record trial balance, adjusting entries, adjusted trial balance, income statement and balance sheet for each account.

Expense Report Template

Download Expense Report Template

Microsoft Excel | Smartsheet

Track business expenses such as transportation, entertainment, lodging, and meals with this expense report template. Specify the time frame at the top of the spreadsheet and list all expenses with dates for each transaction. The template provides space to add notes or detailed descriptions as needed.

Chart of Accounts Template

Download Chart of Accounts Template — Microsoft Excel

Create a complete record of all the financial accounts listed in your general ledger. For each account, include the code, a brief description, and the account type, such as asset, liability, equity, or expense. The template also lists the financial report associated with the account, such as a balance sheet or income statement, and specifies whether a debit or credit increases the amount in the account.

Monthly Bank Reconciliation Template

Download Monthly Bank Reconciliation Template

Microsoft Excel | Google Sheets

Reconcile a financial account by creating a record of transactions to compare to your bank statement. This reconciliation template includes sections for recording deposits in transit and outstanding checks, and it automatically calculates your statement balance. Duplicate the template to create a continuous monthly report.

For related templates, including those for reconciling petty cash and general ledger accounts, see our collection of free reconciliation templates.

Small Business Budget Template

Download Small Business Budget Template — Microsoft Excel

This budget template includes tabs for recording income, expenses, and cash flow. Create a list of income sources and business expenses. As you add amounts received or spent on each item, the template calculates monthly and yearly totals. Use the cash flow tab to record transactions and monitor your cash balance.

Monthly Mileage Log Template

Download Monthly Mileage Log Template

Microsoft Excel | Microsoft Word | Adobe PDF

Use this mileage log template to track business vehicle use and mileage costs. The template includes columns for travel dates and purpose, starting and ending points, odometer readings, and total miles. If you are using this sheet to reimburse employees, enter the reimbursem*nt rate at the top of the template to determine the total amount owed.

Employee Timesheet Template

Download Employee Timesheet Template — Microsoft Excel

Track employee hours and calculate wages due on a weekly basis. This timesheet template includes break time, regular and overtime hours, sick days, vacation time, and holidays. Enter the starting date for the week at the top of the template, and the dates will automatically populate the timesheet. View hourly rates, total hours, and total pay for each day and week.

Payroll Register Template

Download Payroll Register Template

Microsoft Excel | Smartsheet

This payroll register template includes a pay stub and a register of employee information to help you process payroll. The pay stub tab displays payment and withholdings for an individual employee, while the register lists employee job titles, salaries, vacation and sick allowance, and pay schedule. It also shows pre- and post-tax deductions, such as 401(k) contributions and insurance, and federal and state taxes.

What Are Bookkeeping Templates?

Bookkeeping templates are documents that help you track and manage financial data and business performance. For small businesses, templates provide an easy way to record payments and expenses, generate financial statements, process payroll, and prepare for tax reporting.

Simplify Your Bookkeeping and Financial Reports with Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change. The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed. When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time.Try Smartsheet for free, today.