Updated - August 18, 2023 at 09:01 AM.

Suitable option for those looking for healthy long-term returns with moderate risks along the way

By Venkatasubramanian KBL Research Bureau

For mutual fund investors who have spent years or decades juggling equity schemes, HDFC Flexi Cap (HDFC Equity earlier) would be a familiar name. The fund, with Rs 36,345 crore in assets under management as of June 2023, has been around for more than 28 years. From 2003 to 2022, it was managed by the legendary Prashant Jain. HDFC Flexi Cap’s fund manager for the past one year is the seasoned Roshi Jain.

History aside, the fund, given a sufficiently large timeframe of 7-10 years, has been a solid performer. A fund with a strong large-cap and value bias since Jain’s times, HDFC Flexi Cap follows a ‘buy and hold’ policy and long-term investors do reap rewards if they hold on to the units of the scheme. It has delivered a staggering 18.5 per cent annually since launch in 1995.

A 20-year SIP in the fund would have delivered 16.35 per cent returns (XIRR).

In a category where many new and old funds are doing quite well and snapping at its heels, the fund can still be a choice for investors with an average risk appetite. Taking the systematic investment plan (SIP) route may be ideal for targeted savings towards specific life goals.

Steady long-term performer

HDFC Flexi Cap can deliver above-average returns over the long term. This has been demonstrated consistently over the past couple of years. But the fund can have bouts of underperformance, sometimes even extending to a couple of years at a stretch. Ultimately, the portfolio picks with the underlying value focus, do pull up the fund’s returns in broader market rallies. For example, in the period around the time SEBI’s recategorisation norms were announced in 2017 and a few years afterwards, the fund lagged peers and the benchmark. But from 2020, it has more than made up by fully participating in the broader market rally, as its past bets began to pay off.

Over the past 10- and 5-year periods, the fund has delivered 18.1 per cent and 15.3 per cent, respectively, on a point-to-point basis. This performance places it among the top quartile of funds in the category.

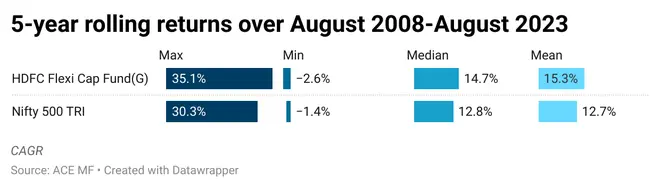

When five-year rolling returns over the past 15 years (2008-2023) are considered, HDFC Flexicap has delivered mean returns of nearly 15.3 per cent. This performance is higher than that of Franklin Flexi Cap, Aditya Birla SL Flexi Cap and HSBC Flexi Cap.

Also, in the 15-year period mentioned above, on a five-year rolling basis, HDFC Flexi Cap has beaten its benchmark, the Nifty 500 TRI, nearly 75 per cent of the times. It has delivered more than 15 per cent nearly half of the time over this period and more than 12 per cent nearly 69 per cent of the time. The fund has an upside capture ratio of 113.1, indicating that it rises more than the benchmark during rallies, while a downside capture ratio of 87.4 suggests that it falls less than the index during corrections.

Also read: Test findings.₹1.08-lakh crore AUM of debt mutual funds under stress

Value, large-cap focus

HDFC Flexi Cap has generally had a strong large-cap bias in its portfolio construction. And most of the time, the top 10 holdings and indeed a substantial portion of the assets itself are focused on constituents of the Sensex, Nifty, and a few others in the top 100 market-cap basket.

Some of the fund’s bets on public sector and select private players in the banking, power, FMCG and construction spaces have rewarded the scheme handsomely in the rally from 2020. So, its stakes in State Bank of India, ICICI Bank, NTPC, ITC, Reliance Industries, and L&T have delivered well and added to the fund’s returns.

Over the last one year, while the broad structure of the fund and its value focus remains intact, there are a few noteworthy changes that the new fund manager appears to have brought in. So, ITC and Reliance Industries do not figure in the top 10 holdings going by the June factsheet. We also have new entrants such as Mahindra & Mahindra, HCL Technologies, Hindustan Aeronautics, and Cipla in the top holdings of the fund. These represent a blend of value and momentum picks.

Another aspect is that large caps seem to have gone up in proportion, from about 75-76 per cent earlier, to nearly 82 per cent. Mid and small caps account for less than 5 per cent each in the portfolio. Earlier, the percentage of mid-caps would be in double-digits. The current shift may also be a function of the fund’s large size.

Finally, earlier, HDFC Flexi Cap would remain more or less fully invested. In recent times, the fund has not been averse to taking cash and even REIT positions in its portfolio. In the June portfolio, the fund has only about 91 per cent in equity.

Overall, the fund would be suitable for those looking for healthy long-term returns with moderate risks along the way.

Related Topics

- mutual funds

COMMENT NOW

COMMENT NOW