- Find a location

- Make an appointment

- Quick help

Back

Clear Access Banking

An account that helps you spend only what you have in it

Prime Checking

Many discounts and benefits are included with this interest-bearing account

Everyday Checking

Our most popular account for managing day-to-day financial needs

Premier Checking

An interest-bearing account with our premier level of relationship banking benefits

Student/teen banking

Account options ideal for teens and students

Back

Back

CREDIT CARD SERVICES

EDUCATION & TOOLS

Back

Buy a home

Get started on your homeownership journey

Refinance your mortgage

Do home repairs, reduce payments, or more

First-time home buyers

See low down payment options and key steps

Current customers

Manage your account with our digital tools

Get prequalified

Know how much you qualify for in minutes

Start your home search

Access our exclusive tool for customers

MORTGAGE SERVICES

EDUCATION & TOOLS

Back

Personal loans

Learn how a personal loan can help you with funds for life events like graduations and weddings, adoption and fertility, or other needs

Loans for home improvement

Use a personal loan to pay for home renovations and repairs

Finance a large expense

Pay for new appliances, car repairs, medical expenses, and more

Consolidate debt

Combine your higher-interest debt into one manageable payment

PERSONAL LOAN SERVICES

EDUCATION & TOOLS

Back

AUTO LOAN SERVICES

EDUCATION & TOOLS

Back

BANKING SERVICES

DIGITAL BANKING

Back

Welcome

Sign on to manage your accounts.

Notice

For your security, we do not recommend using this feature on a shared device.

Say hello to convenient checking

Explore our checking options and choose the right account for you

Financial guidance and support

Spend less. Save more. Relax more.

These four steps could help you make it happen

Reduce debt. Build credit. Enjoy life.

Discover four steps that may help you reduce debt and strengthen credit

Get tools. Get tips. Get peace of mind.

Discover digital tools to help you budget, save, manage credit, and more

Banking in the palm of your hand

Our Wells Fargo Mobile® app gives you fast and secure access to your finances

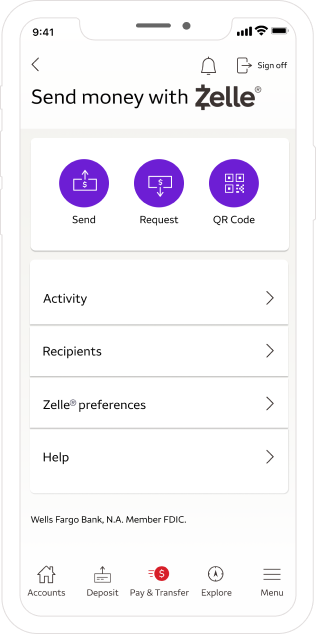

Banking in the palm of your hand

Our Wells Fargo Mobile® app gives you fast and secure access to your finances

- Check your account balance

- View your latest FICO® Score1

- Send and receive money with Zelle®2

Download our app

App Store Google Play

*Screen image is simulated

Serving our customers and communities

It doesn't happen with one transaction, in one day on the job, or in one quarter. It's earned relationship by relationship.

Who we are

Wells Fargo helps strengthen communities through diversity, equity, and inclusion, economic empowerment, and sustainability.

Why we're committed to communities

We don't just serve our communities—we are our communities. We're committed to helping customers and neighborhoods across the country thrive.

- Find a location

- Make an appointment

- Quick help

- Deposit checks

- Stay informed with push notifications

- Sign on using your fingerprint or FaceID®

By selecting Get the app, you are leaving wellsfargo.com and entering a website that Wells Fargo does not control. Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

You are leaving the Wells Fargo website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control.

Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

ContinueCancel

You are leaving the Wells Fargo website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control.

Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

ContinueCancel

You are leaving the Wells Fargo website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control.

Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

ContinueCancel

You are leaving the Wells Fargo website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control.

Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

ContinueCancel

You are leaving the Wells Fargo website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control.

Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

ContinueCancel

You are leaving the Wells Fargo website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control.

Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

ContinueCancel

You are leaving the Wells Fargo website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control.

Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

ContinueCancel

You are leaving the Wells Fargo website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control.

Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

ContinueCancel

You are leaving the Wells Fargo website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control.

Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

ContinueCancel